Talk with a Tax Professional Today

We utilize innovative tax software to streamline your cryptocurrency and DeFi tax preparation process.

Our goal is to save you time, minimize your tax liabilities at the state, local, and federal level, while ensuring compliance with all US tax reporting requirements.

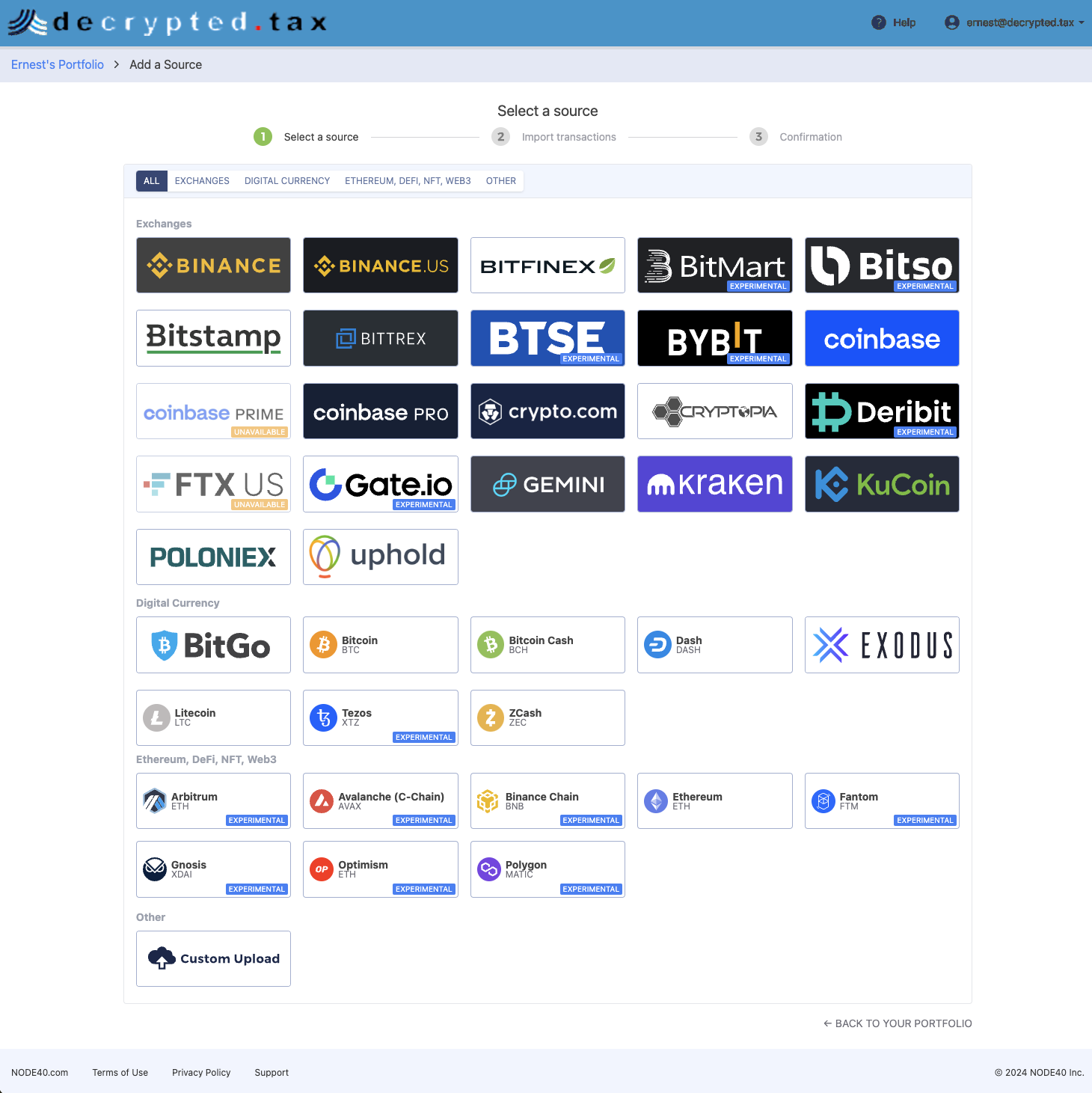

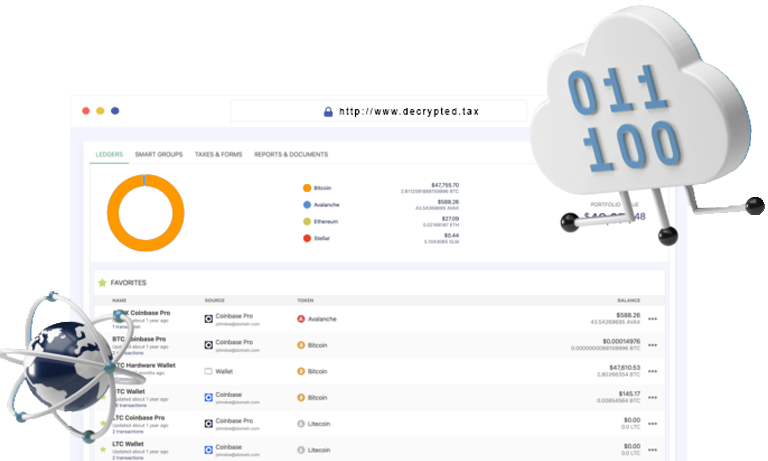

Consolidate all your digital assets in one convenient location for seamless tax form generation and review. Our system ensures that every transaction is accounted for, making it easy for a Decrypted Tax professional to meticulously review and prepare your tax forms.

This streamlined approach not only simplifies the tax preparation process but also enhances accuracy and compliance with all relevant tax regulations.

We calculate your gains and losses for all your transactions, including trading, staking, NFTs, and DeFi activities. Our comprehensive service ensures every aspect of your digital asset transactions is accurately accounted for.

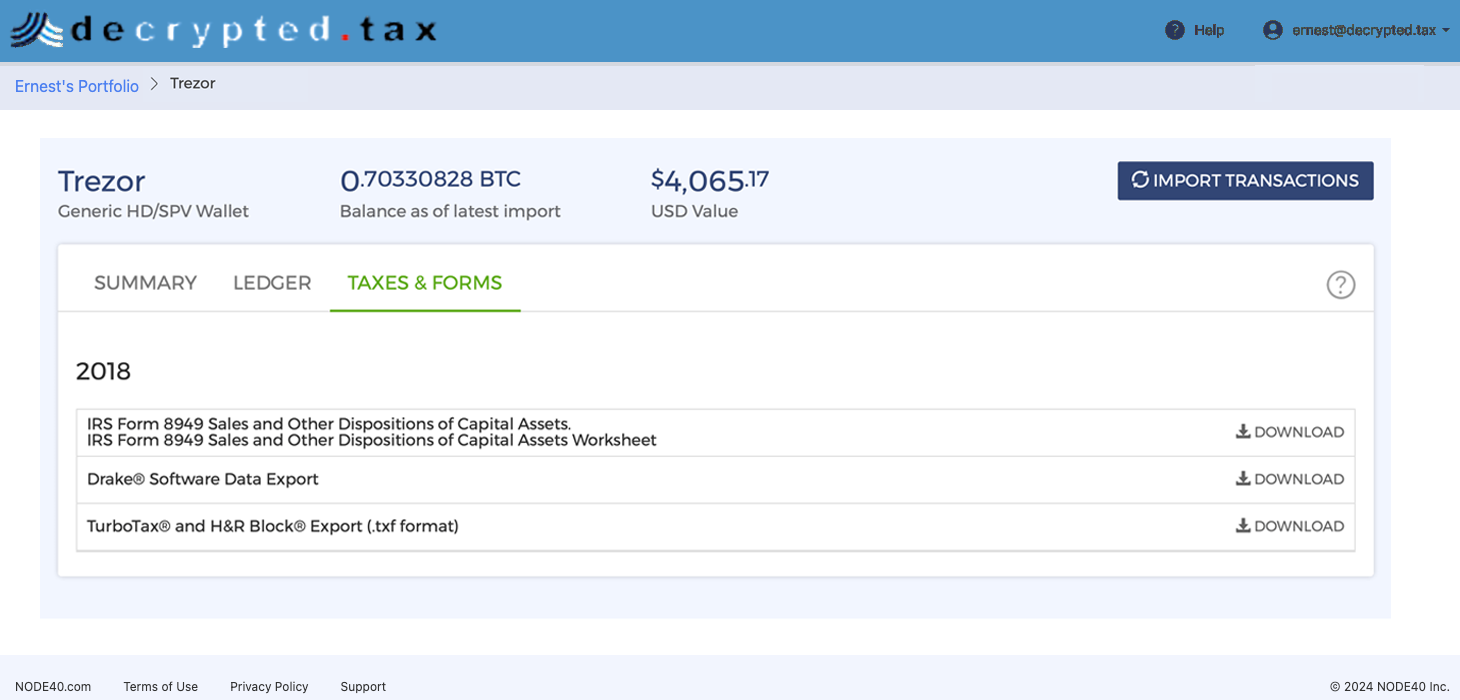

Decrypted Tax is dedicated to simplifying your tax filing process. We handle the generation of your IRS Form 8949 and Schedule D with precision, ensuring all your transactions are accurately documented. Additionally, we prepare a comprehensive audit trail to ensure full compliance and provide peace of mind. Our goal is to make tax season stress-free by managing the complexities of cryptocurrency tax reporting for you.

This form is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

© 2024 Decrypted.tax | All Rights Reserved | Developed By SEO St George Utah